Roth ira income limit calculator

Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. Roth ira income limits.

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

For 2022 the maximum annual IRA.

. Start with your modified. In the United States an IRA individual retirement account is a type of retirement plan with taxation benefits. 9 rows Subtract from the amount in 1.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. Starting in 2010 high income individuals have the option to make. Certain products and services may not be available to all entities or persons.

Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. But for Roth IRA there is an additional contribution limit that is based on how much income you have in the year of deposit. Your Roth IRA contributions can have a big impact on your total investment portfolio.

Not everyone is eligible to contribute this. Annual IRA Contribution Limit. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

As mentioned before the limits are adjusted gross incomes of 144000 for individuals or. If you file your tax return for 2022 as a single filer or head of household You can contribute up to the Roth IRA limit if your Modified Adjusted Gross Income MAGI is below. This calculator assumes that you make your contribution at the beginning of each year.

Eligible individuals age 50 or older within a particular tax year can make an. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. Nearly everyone who has earned income is eligible to contribute to an IRA of some kind.

Date Title URL. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at. If you would like help or advice choosing investments please call us at 800-842-2252.

Unlike taxable investment accounts you cant put an. This Roth IRA calculator shows you the impact of tax savings. For 2020 Roth IRA.

For the purposes of this. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. Roth IRAs have income limits that prohibit higher earners from contributing.

Roth ira income limits. For the purposes of this calculator we assume that your income does not limit your ability to contribute to a Roth IRA. The amount you will contribute to your Roth IRA each year.

We are here to help. For some investors this could prove to. Roth IRA Contribution and Income.

Married filing jointly or head of household. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. If you file your tax return for 2022 as a single filer or head of household You can contribute up to the Roth IRA limit if your Modified Adjusted Gross Income MAGI is below.

Income limitThe income limit disqualifies high income earners from participating in Roth IRAs. Amount of your reduced Roth IRA contribution. The Roth IRA income limit refers to the amount of money you can earn in income before the Roth IRA maximum annual contribution begins to phase down.

Pin On Parenting The same. Keep in mind that your eligibility to contribute to a Roth IRA is based on your income level. The 2020 limit for contributions to Roth IRA is.

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

Earlyretirement Retirement Calculator Early Retirement Retirement

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Net Worth Calculator Personal Financial Statement Net Worth Event Planning Template

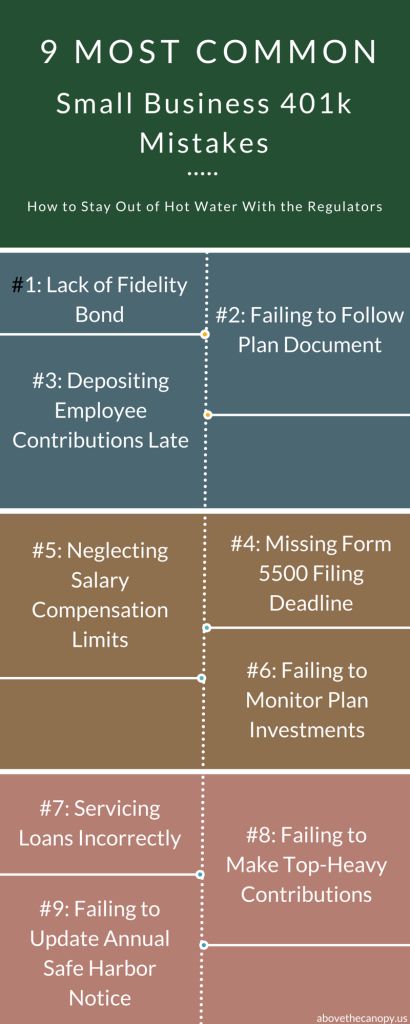

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Roth Vs Traditional Ira Traditional Ira Roth Vs Traditional Ira Ira Investment

Roth Ira Vs Traditional Ira Differences In Rules Limits Roth Ira Traditional Ira Ira Accounts

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Pin On Finanzielle Planung 2019

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Pin On Usa Tax Code Blog

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Komentar

Posting Komentar